In a continuously changing economic environment, the lawyer has to closely observe the developments, while practicing his profession with a great sense of responsibility.

The lawyers of MStR Law, having a profound legal knowledge and specialization, are constantly informed and up-to-dated on the legislative changes, they actively participate in social processes and events and remain close to their clients, in order to offer, at any time, their thorough legal knowledge and advice, by defending their rights judicially and extra-judicially. At the same time, they express the enduring core values of the lawyer’s profession and show respect towards the professional history of the past generation lawyers.

Today, MStR Law has managed to be at the centre of developments in Greece, supporting a demanding clientele of individuals and companies coming both from Greece and abroad.

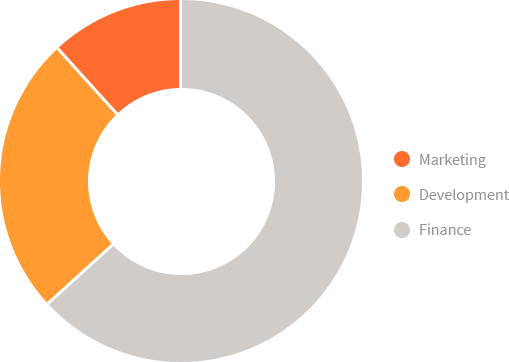

Corporate finance

Advanced analytics

Chain management

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque mauris ipsum, commodo vitae justo sed, gravida porta leo. Sed sit amet urna tortor. Donec eu ligula lorem. Sed id fringilla urna, auctor porta leo.

Οι δικηγόροι της εταιρείας μας καλύπτουν κάθε θέμα αστικού δικαίου, είτε αφορά την προστασία της περιουσίας, κινητής ή ακίνητης, είτε τις συναλλαγές, είτε τη ρύθμιση ή διάπλαση σχέσεων οικογενειακού ή κληρονομικού δικαίου…

Οι δικηγόροι της εταιρείας μας καλύπτουν κάθε θέμα αστικού δικαίου, είτε αφορά την προστασία της περιουσίας, κινητής ή ακίνητης, είτε τις συναλλαγές, είτε τη ρύθμιση ή διάπλαση σχέσεων οικογενειακού ή κληρονομικού δικαίου…

Οι δικηγόροι της εταιρείας μας καλύπτουν κάθε θέμα αστικού δικαίου, είτε αφορά την προστασία της περιουσίας, κινητής ή ακίνητης, είτε τις συναλλαγές, είτε τη ρύθμιση ή διάπλαση σχέσεων οικογενειακού ή κληρονομικού δικαίου…

win championships!

Experts

Branches

Projects

Clients